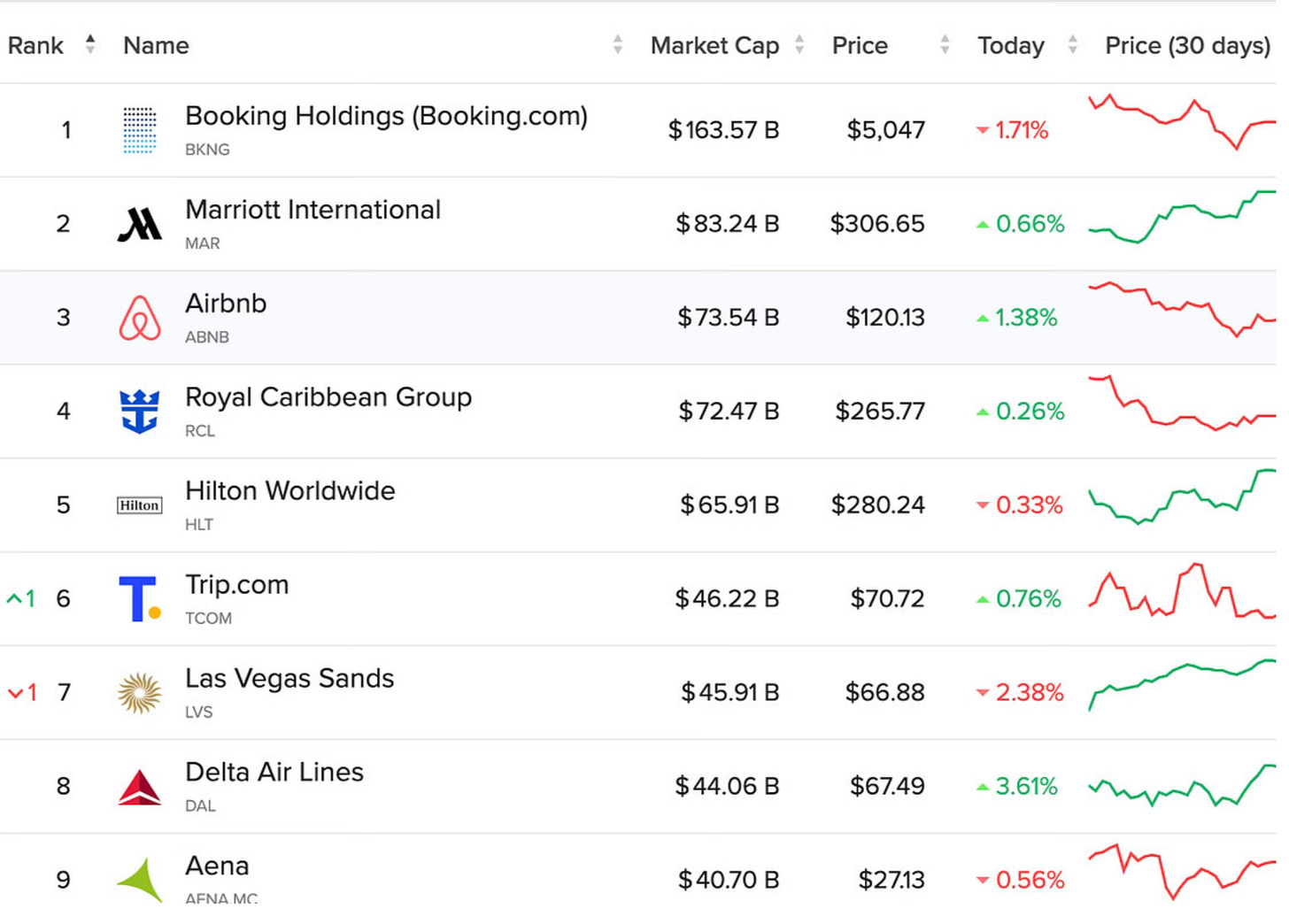

I got to sit down with Glenn Fogel, CEO of Booking Holdings, the largest travel company in the world. BK 0.00%↑ NG market cap was $160B as of Dec 3, when I am publishing this. For context, it’s market cap is ~2x that of Marriott and AirBnB, which are 2 and 3. Here is a chart of the rest on the list:

I knew travel was big but I did not know it was roughly 10% of Global GDP. According to World Travel & Tourism Council, in 2025 travel is expected to contribute an all-time high of $11.7 Trillion to the global economy, a 7.3% growth since 2024. The global travel industry has seen a better growth rate than the $AMZN stock over the last year. (6.5% growth over the last year and this is not investment advice)

We have all made restaurant reservations through Opentable, booked a flight through Kayak, a place to stay with Booking.com or found great deals at Priceline, these brands along with Agoda and Rentalcars make up what is now known as Booking Holdings, previously known as Priceline Group.

Glenn has been at the company for 25 years, started out leading corp dev and has now been CEO for almost 9 years. When he joined the company in 2000, it was in the middle of the dot com crash and the company was at it’s lowest with a market cap of $0.25B at the end of the year. He has been there for the dot com crash, the global financial crisis of 2008/09 and COVID. Since Glenn took over as CEO in 2017, both the market cap ($72B - $160B) and revenue ($12.6B - $23.8B) have roughly doubled.

Founding history: Booking was known as Priceline Group until 2018. Priceline was founded back in 1997 by Jay Walker with a “name your own price” model for hotels, flights, car rentals etc and went public on NASDAQ in 1999. Many might not know this, but Priceline was spun out of Walker Digital which was sort of a venture studio/IP research lab that Jay founded in 1994 and ran out of Stamford Connecticut.

Glenn led the charge on acquiring Booking (a Netherlands based company) way back in 2005 for $133m. Accommodation bookings now account for more than 85% of total Booking Holdings revenue which back in the day was a smaller subsidiary of then Priceline Group. He credits his prior career in investment banking to preparing him for the M&A role at Booking, where he saw a lot of deals not be successful for the acquirer.

Interestingly, Expedia was also started around the same time, in 1996 (their market cap is around $27B). One thing Booking has done really well is growing all brands independently with different CEOs post acquisition. It is interesting how they have managed to successfully operate under a more decentralized management structure.

Glenn is incredibly candid and a joy to talk to, we tee it off by talking about history. Hope you enjoy!

Timestamps:

00:00 - Introduction

00:15 - Getting into world history

08:19 - Peter Thiel on Rise and Fall of empires

11:34 - The India-Pakistan partition

19:45 - Glenn Interviews Suffiyan

28:05 - Groundbreaking programs from the past

32:27 - The start if Glenn’s career at booking

35:57 - How Glenn thinks about acquisitions

41:48 - Acquiring Expedia? What went right for Booking

51:59 - Current issues in travel that are billion dollar business opportunities

57:27 - Leadership and training talent

1:05:58 - Passing down the torch

1:10:53 - The best use of the CEO’s time

1:18:52 - Importance of storytelling

1:26:47 - Important of decision making and compounding

1:32:26 - Changing how airports operate and speed of travel

1:36:40 - Advice to younger audiences and the state of schooling

1:42:24 - Leaders Glenn admires

1:45:44 - Rapid fire ending